You are probably familiar with owning a house and renting it out to tenants. That’s how most real estate investors “get their feet wet” in real estate. Sometimes they’ll flip a house, or even buy a duplex to explore ways to grow their real estate portfolio. We began with house hacking and short term rentals, for example.

You are also probably familiar with the headache of managing real estate properties. Yea, we are too.

Yet, behind each of these rentals is an opportunity to grow your wealth without any tenants, termites or toilets. And that is the note. You might know it as the mortgage. The note is the connection between the buyer of a house and the lender, which is typically a bank. More importantly, the note attaches the actual house to the loan as collateral.

Banks have found a way to insert themselves into this incredibly lucrative exchange as a bridge between these two parties.

We meet people and even experienced real estate investors all the time who don’t understand the world of notes that hides behind every real estate transaction. It’s pretty common. It’s kind of tricky to wrap your head around.

But it is worth it.

Owning the note typically means making higher returns without ever getting a call from a tenant. Risk is mitigated multiple ways, like through heavy due diligence to determine the value of an asset, as well as through immediate equity in the deal. And finally, if your borrower stops making monthly payments, you have the house as collateral.

But I’m getting ahead of myself.

You are probably wondering things like:

- What is a note?

- How does a note purchase work (plus an example)? (Part II)

- Why should I put my money in a note? (Part III)

We’ll take a look at each of these questions in more detail in this Ultimate Guide to Real Estate Secured Notes series.

First, let’s start with the basics of what exactly is a note. We’ll dive into different types of notes and end with an overview of how much work is involved in owning a note.

A Real Estate Backed Note – What’s That?

A note is a promise to repay a loan. If you have any debt (student loan, car, credit card, etc.), then you are involved in a note and have signed a promissory note document that states those terms.

Some of the bigger notes are in real estate, often called a mortgage or deed of trust. In fact, there is both a promissory note and a mortgage or deed of trust in every real estate secured note. While the promissory note states the terms, the mortgage or deed of trust attaches the real property (asset) to that promissory note as collateral. So, the mortgage securitizes the loan with an asset.

You are probably familiar with this scenario.

You are ready to buy a home. You have a 20% down payment, let’s say $25,000, and a bank lends you the $100,000 (or 80%) so that you can pay the seller 100% of the agreed upon price for the house, or $125,000 in this case. The bank creates the loan documents (the note or “the paper”) and becomes the note holder. Then you make monthly payments back to the bank to repay that $100,000 that you borrowed (at 5% interest, which is key here) over a term of 30 years.

You are happy because you didn’t have to come up with 100% of the asking price, but the bank is getting an even better deal. The bank has a monthly income stream that is secured by the asset (or house). Meaning, if you stop paying, the bank can take 100% of the house (not just the 80% that is still owed).

Did you catch that?

The bank’s risk is immediately mitigated because they have only lent out 80% of the house’s value but have a claim on 100% of the asset as collateral until the note is paid in full.

This is so important. Having security is what makes lending in real estate such a good investment. An investor can protect their investment with a mortgage or deed of trust.

So, notes are the paper side of real estate and the house is the safety net for that investment.

Performing and Non-Performing Notes: The Surprising Favorite

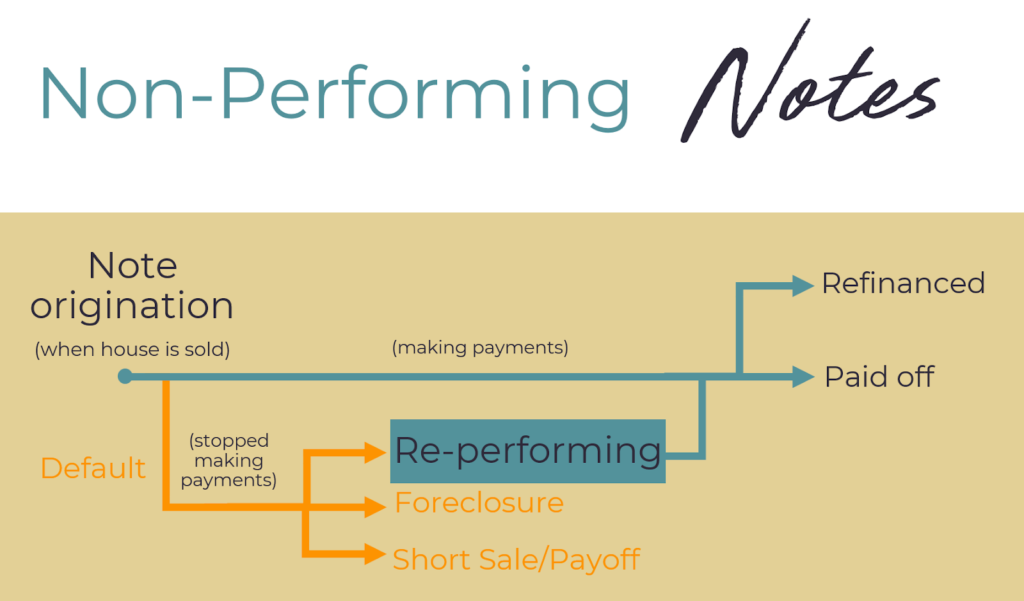

As a homeowner makes payments every month, a portion goes toward paying down the principal balance, or $100,000 from the example above. A portion of each monthly payment also goes to the bank (or note holder) as interest. This is a performing note. If a homeowner stops making payments on a home loan, that becomes a non-performing note.

A non-performing note may initially sound scary, but it is actually our favorite type of note. Here’s why.

When a borrower stops paying their mortgage, it typically means they are distressed. Something in life happened and they just can’t make their payment. As note investors, we can actually help that borrower get back on track while also mitigating our risk and making higher profits.

First, we purchase a non-performing note at a steep discount, say 50 cents on the dollar. We’ve performed extreme due diligence to confirm the value of the property, so we know that if we have to take back the house, we can still sell it for a profit.

Second, we can now set new terms that fit into the homeowner’s budget, allowing them to start making payments again. Because the borrower could likely not qualify for traditional financing elsewhere and is considered higher risk for defaulting (in fact, they’ve already defaulted), we mitigate our risk by charging a higher interest rate. They key here is that we change other loan terms (balance and number of years) so that the borrower can still afford payments.

Once payments have started again, the note becomes a re-performing note. Note owners can hold a reperforming note and enjoy the passive income every month, or resell the note for an even bigger profit. Since the note is now performing, it could be sold for $0.90 on the dollar, or even the full unpaid balance.

Remember, we bought the note for 50 cents on the dollar ($50,000) and just rehabbed it to be worth 90 cents on the dollar ($90,000). That’s $40,000 profit.

If the borrower can’t get back on schedule, we can always take back the property to pay off the remaining debt. Sometimes this is through a foreclosure, but there are a lot of other exit strategies that can work for both us and the homeowner.

This is why we chose note investing as our favorite wealth building strategy. We can mitigate risk by purchasing assets for pennies on the dollar and take advantage of many different exit strategies. But what really brings it home for us is that our money is helping people stay in their own homes. We can intervene where the big banks would simply move toward foreclosure. We can set new terms and help the borrower get back on track with payments. They keep their home and we still get juiced returns with less risk. Everyone wins.

$50,000 in a Note Instead of A Rental – How Much Work Is It?

Now that you have an understanding of what a note is, let’s look at how much work it is to grow your money through real estate secured notes.

Let’s pretend you have $50,000 for investing in real estate, beyond your employer’s retirement account option and savings funds. You could invest it in an individual rental property, but that requires time to find a property, run the numbers, negotiate the contract, order the inspections, get the loan, plus find the tenant and manage the property.

You likely don’t have the time or desire to deal with such an obligation. This is where most people assume real estate investing is too hard and too much work, so they stop there.

Purchasing a note is the alternative that allows you to still put your money into real estate, without having to do the work of finding or managing the property yourself. Instead, you can partner with an experienced note buyer, like us here at Flow State Investing, with that $50,000. Of course, you will find a partner who has the track record, the connections and the systems to vet and manage a note because you want your money to work hard for you. You will spend time upfront learning about how the partnership works and then be involved at a few key decision points in the management of the asset.

Other than that, your work is done. No vacancies to fill, no rehabs to manage, no roofs to repair. We do the heavy lifting of extreme due diligence, communication with the borrower, and management of the process. You receive regular updates and participate in any important asset management decisions. You’ll receive monthly cashflow the note generates, and get back your original capital plus the returns upon sale of the note.

And let’s just say, those returns are pretty incredible. Think about the banks. They have found that the money is in the notes, not the real estate. Yet, real estate is their safety net and ultimate risk mitigation tool for their investment.

Conclusion

Notes are the hidden gem behind every real estate transaction. We’ve found that a note is a contract between a borrower and a lender that stipulates the terms of the loan. And in real estate secured notes, there is real property as collateral in that loan.

In Part II of Your Ultimate Guide to Real Estate Secured Notes, we’ll dive deeper into how a note purchase works. We’ll discuss how the process works, ways risk is mitigated, and review an example of how a note purchase is made.

0 Comments