Ok, we’ve covered what a real estate backed note is and a few different types of notes, like performing and non-performing notes in Part I of this series. Head over there if you need to brush up on those basics.

So you understand what a Note is and how it can be an incredible wealth building tool

- What is a note? (Part I)

- How does a note purchase work (plus and example)?

- Why should I put my money in a note? (Part III)

How Does A Note Purchase Work?

Now you’re interested in the “behind the scenes” details of a note purchase to see how this all really shakes out.

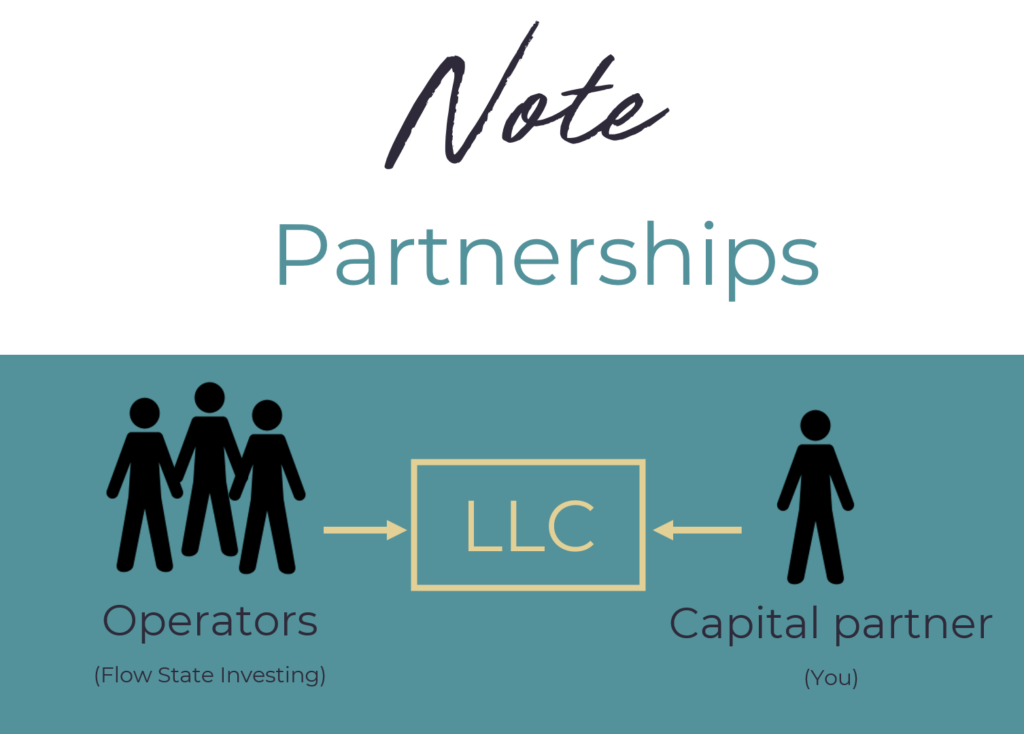

First off, there are two parties that come together to purchase a note: the operators (Flow State Investing) and the capital partner (you). They create an entity (usually an LLC) that holds the note. Technically, this is not an investment but rather a partnership. This is because under that entity all parties must play an active role. Let’s look at that in more detail.

Purchasing a note requires a ridiculous amount of due diligence before even making an offer. When purchasing non-performing notes, a detailed analysis of the asset (the actual home), the borrower (using legal and ethical means) and the documentation (the actual paper trail) is performed. This involves reviewing recorded documents, tax payment history, legal review, servicer comments, market analysis, current market value estimates, and more.

Don’t worry. These tasks are all performed by the operator and presented to you, the capital partner, for review.

It is incredibly important that you partner with an experienced and educated team who knows what to look for here. This unique and extensive due diligence process is the first and most important way to mitigate risk. By having a clear picture of the market, the asset value, the borrower’s history, and the quality of the documentation, an offer can be made that provides enough equity cushion to make a number of exit strategies viable.

Essentially, operators do all the legwork of finding and vetting the note, negotiating purchase price and creating the business plan. They then bring this information to you as a partner for review and all parties agree upon a decision.

When a key decision point is reached, all partners in the deal come together to make a decision. This is typically a quick phone meeting where the operators present all the details. This makes all parties active in the purchase of the note without putting in equal amounts of time and effort.

As a capital partner, most of your work is up front in vetting an operator and then after the partnership begins, you’ll occasionally provide input at those key decision points. No leaky roofs, no troublesome tenants, and no property managers.

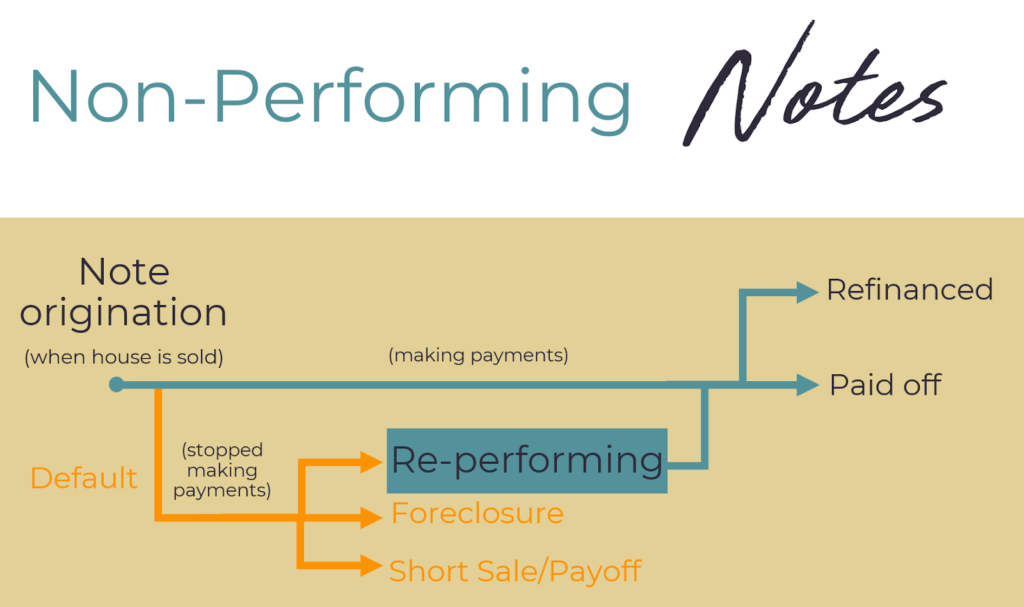

Getting a Non-Performing Note to be a Re-Performing Note

After all partners agree to purchase, the operators move forward with the business plan. Often, this means working toward getting the borrower to start making payments and keep their home. This involves working through a servicer to communicate with the borrower. We can learn more about their unique financial situation and assess whether they are willing to work with us to keep their home. The operators create new terms that both help the homeowner afford payments and still provide the highest returns for the partnership.

We love getting a non-performing note to re-perform. We prefer this exit strategy because it provides the highest return for our partnership, as well as improves the communities where we invest. However, there are over 20 exit strategies available to us if re-performing doesn’t work. Can you say risk mitigation?

Projected returns are higher for re-performing a note, but we like to look at average projected returns. We’ve found that out of every 5 notes, we can get 2 to re-perform, 2 go to foreclosure and 1 goes to Deed-in-Lieu or another exit strategy. When a note cashflows or is sold, the partnership splits the profit. Typically, average note returns for all of these outcomes are slightly better than those seen in hard money lending, or 10-15% total annualized return for a capital partner.

You could expect your money to be tied up in the note purchase for about 2-3 years. Sometimes less, but it is always better to assume the longer time frame. Even though Notes are don’t hold your money for as long as a rental property or multi-family syndication investment, you should always expect to have your money in the deal for several years.

An Example Note Purchase Deal:

Okay, so you’re interested, but you’re still like, “Is this real?” Here’s an example of what a non-performing note deal would look like.

Let’s say that Kate and Kyle are working together to find notes to buy. They have built relationships with asset managers at the institutions that sell performing and non-performing notes. They have the analysis systems set in place to combine the information provided by the asset managers with additional research. This will create a more realistic assessment of the property, the borrower and the documentation.

Kate and Kyle have built the systems to underwrite and manage the asset, so they put together a Joint Venture partnership offering. They look for potential partners who want to contribute a minimum of $50,000 in one or more of the notes they have access to buy. They present a business plan to potential capital partners and work with an attorney to structure the deals. Each partnership will be a separate entity that purchases specific assets. Capital partners won’t be pooled together to purchase a single asset.

Potential partners look over the legal documents and the business plan before signing and transferring funds.

Kate takes the lead on the underwriting (i.e. analyzing all the numbers to make sure the note or notes will be profitable under multiple exit strategies) and Kyle works with the asset managers to make offers on one or more notes.

Once an offer has been accepted, the team goes into an even deeper due diligence dive. If there are no unexpected surprises, a summary of the note(s) are presented to the capital partner for review. Once approved, the notes are purchased and Kate and Kyle begin working toward the preferred exit strategy (typically getting the borrower to re-perform).

The capital partner will receive regular quarterly updates on the status of the notes and be called upon at key decision points for input (such as if any legal action like a foreclosure will need to take place or if the note is ready to be resold).

In the most ideal scenario, Kate and Kyle will work with the borrower to get them back on track with payments, which is called a re-performing note. The partnership will determine the new terms that help the borrower and get high returns for the partnership members. The capital partner will receive monthly cashflow checks. Once the borrower makes enough monthly payments to “season” the note, Kate and Kyle determine that it is a good time to sell the note as a performing asset to get the highest return on the initial funds input into the deal.

After a review with the capital partner, the note is sold. Upon the sale of a note, the capital partner receives their original capital plus their split of the profits according to the JV agreement. In this case, a 50/50 split was agreed upon at the outset of the deal (50% to capital partner, 50% to Kate and Kyle).

At this point, the capital partner has received monthly cashflow checks if the asset became re-performing, plus their initial capital investment back once the asset sold, plus their portion of the profit split after the sale…a pretty sweet deal for little-to-no work!

A Diversified (and Amplified) Note Purchase

As your relationship grows with an operator, you may find that you want to purchase notes in bundles. This strategy allows for a more diversified approach.

Since not every not every borrower has the ability (or desire) to get back on track with payments, a single note partnership may not end with this exit strategy. However, when purchasing bundles of notes, such as 5-10 at a time, the likelihood of getting several notes to re-perform is higher.

Additionally, this partnership strategy allows for quicker recapitalization since some notes turn over quicker than others.

In Conclusion

Now that you know the ins-and-outs of a secured real estate note purchase, including what it is, how it works, how little effort on your part it requires, and how simple it could be to begin getting better returns than the stock market with less work than managing rental properties, don’t wait 10 years to make a move!

We always recommend you research until you’re comfortable with the process and the partners. We hope that your investing strategy feels like every dollar you put out to work is growing at its highest rate while also increasing your time freedom and enjoyment of life. That is a financial flow state.

Now that you’re armed with this knowledge about real estate secured notes, you are well on your way to achieving your own financial flow state.

0 Comments